Finnair Hard Hit By Russian Airspace Closure Bounces Back

26 September, 2022

7 min read

Geoffrey Thomas

By joining our newsletter, you agree to our Privacy Policy

Finnair, which will celebrate its hundredth anniversary in late 2023, has been hard hit by the closure of Russian airspace - its quick access to Asia - but it is fighting back.

The airline with a fleet of 80 aircraft and almost 15 million passengers annually carried pre-pandemic looks back on a proud history, but this year lost its unique market niche almost overnight, after building it to perfection over almost four decades.

The airline started the first non-stop flight from Western Europe to East Asia in 1983. At the time it was not permitted to use Soviet airspace, but due to Helsinki’s location in the far north-eastern corner of Europe, a modified DC-10-30ER with additional fuel tanks was able to do the trick and reach Tokyo in 13 hours via the North Pole.

A big advantage at a time when almost all passenger flights from Europe and North America to Japan had to put in a fuel stop in Anchorage, Alaska. That stretched the elapsed travel time to 16 hours.

In 1994, Finnair was able to enter Russian airspace after a few minutes of flying east of Helsinki and reached Tokyo on this shortcut route in just about nine hours.

Finnair and Helsinki Airport evolved their business model to perfection, adapting everything to swift transfers and the needs of Asian passengers. No other airport in Europe sports signage in the terminal’s transfer areas in English plus Mandarin, Korean, Japanese and Russian. The airport has just finished an ambitious expansion programme stretching over a decade and costing about a billion Euros.

The whole concept collapsed in February 2022 when Russia invaded Ukraine and the country closed its airspace for all European Union-based airlines days later, while Chinese, Indian, Arab or Turkish carriers continue to take advantage of these cherished shortcuts over Russia.

“Finland is the world’s most affected country by the Russian airspace closure due to its geography, it is a big problem for sure, you cannot deny that. No other airport has been hit worse by it than Helsinki,” admits airport director Ulla Lettijeff in talking to Airlineratings.com

“We need to fight and generate as much income as possible and somehow fill the gap created by the war and the pandemic.”

easyjet launches ambitious net-zero program

Cathay Pacific Airways welcomes end to HK quarantine

On February 26th, 2022, the good times for Finnair seemingly ended abruptly. That was the last time flight AY073 from Helsinki to Tokyo could take its usual path over Russia. Now, it flies a new route to Tokyo, which is actually the old one of the 1980s via the North Pole. Instead of 7,900 km, the distance the Airbus A350 has to cover is now almost 13,000 km, taking over 13 hours in the air and using more than 40 per cent or 20 tons more fuel.

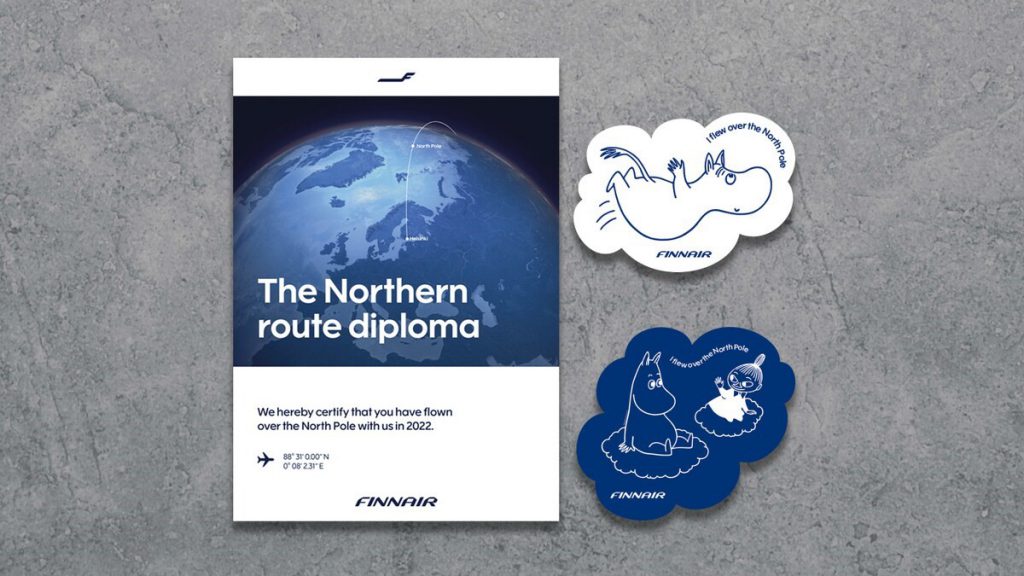

As a small consolation to passengers, Finnair has rolled out its once-famed North Pole certificate again, commemorating overflying the world’s northernmost point. The route to Tokyo is the only connection heading over the pole, while the return flights circumvent Russian territory to the South via Korea, China, Kazakhstan and Uzbekistan to Europe.

“Our geographical advantage is gone, we are getting ready for the situation where Russian airspace will be closed for a long, long period of time, so in our new strategy we adapt to that reality,” Finnair CEO Topi Manner tells Airlineratings.com in an exclusive interview.

One major problem for Finnair is that China is still closed to normal air traffic, which used to be the carrier’s second biggest Asian market after Japan, both countries alone provided Finnair with almost a million passengers a year before the pandemic.

Between 2010 and 2018 alone, traffic to Asia had doubled, over 20 destinations were served from Helsinki, among them six cities in China and four in Japan, and almost a hundred flights a week headed to the Far East then, generating half of Finnair’s revenue.

But its CEO doesn’t want to give up this most lucrative market: “Do not discount Asia, Asia will still be very important for Finnair,” he insists.

While secondary cities such as Nanjing, Sapporo or Osaka will no longer be served, Finnair vies to keep its presence in Tokyo (moving from Narita to Haneda airport, saving passengers time on the ground), Seoul, Singapore, Bangkok and Phuket.

“Once China opens up, and we think it will, we have good chances to fly profitably to Shanghai and Beijing, even with Russian airspace being closed,” says Manner.

Also, Hong Kong and Guangzhou will be served again, plus Delhi and Mumbai. “To provide connectivity from India to the US via Helsinki, India will be one of our growth markets, and the Middle East is another example,” stresses Manner. “The number of Asian destinations will decrease more than their share of the revenue. As yields are going up and once China opens up, Asia can still provide up to 30 per cent of our revenue, from initially just 20 to 25 per cent after the invasion.”

A major cornerstone of Finnair’s new strategy of adapting to a new world is close cooperation with its Oneworld alliance partner Qatar Airways. “Geography is changing due to the Russian invasion, and on the back of that changed geography, we have to change our strategy to establish a more geographically balanced network. This also means the importance of Doha as a hub between East and West is increasing,” stresses the CEO.

“We will fly daily Airbus A330 services from four cities in Europe to Doha starting in November and December, Helsinki, Stockholm and Copenhagen plus a fourth to be announced. We are confident that these flights will be profitable for us, in total there’ll be 28 flights a week during the northern winter, roughly the same number of flights we had into China before the pandemic”, explains Manner.

As a geographical counterweight, Finnair also has introduced a new hub service in the US: “We have opened Dallas/Fort Worth as a new year-round destination to connect with the American Airlines hub, it started well. Our US flights were 90 per cent full in July and the majority of customers started their journey from the US,” reports Manner.

While other bigger airlines have constantly denounced the importance of alliances in recent years, for Finnair its affiliation has become a saviour: “We are benefitting from the Oneworld alliance quite a bit, I would say more than before the pandemic,” he reckons.

And only with such capable partners at hand as his fellow Oneworld carriers giving Finnair a new perspective, he can claim “we are and will continue to be a network airline,” while even envisaging becoming profitable again from 2024.

The Finns are definitely not sacrificing their once-lucrative business to the brutal tunes of their giant neighbour Russia.

Next Article

Virgin gets nod for Tiger deal

Get the latest news and updates straight to your inbox

No spam, no hassle, no fuss, just airline news direct to you.

By joining our newsletter, you agree to our Privacy Policy

Find us on social media

Comments

No comments yet, be the first to write one.