The State of the Asia Pacific Airline Industry

26 March, 2025

3 min read

By joining our newsletter, you agree to our Privacy Policy

As Subhas Menon, Director General of AAPA* puts it, the state of the airline industry mirrors the state of the global economy. It’s a symbiotic relationship—if air travel is thriving, so are tourism, trade, and the overall global economy.

At the Routes Asia 2025 conference in Perth, Western Australia, Menon revealed that growth is now stronger than pre-pandemic levels, reaching 10.5% in 2024 compared to 4.2% in 2019, before COVID-19.

According to IATA, air transport supported 42 million jobs and contributed US$890 billion to GDP in the Asia-Pacific region in 2024. Further evidence of this is the fact that 7 of the 10 busiest international routes are in the Asia Pacific region

As noted by other presenters at this year’s Routes conference, supply chain constraints remain the biggest hindrance to further growth. Scheduled aircraft deliveries of 1,802 in 2025 and 2,077 in 2026 are likely to fall short by approximately 21%. The primary reasons include a shortage of skilled labour, engine issues, limited availability of spare parts, and constraints at Maintenance, Repair and Overhaul (MRO) centres.

All cost components in the industry are rising—labour, parts, and materials—with the sole exception of jet fuel.

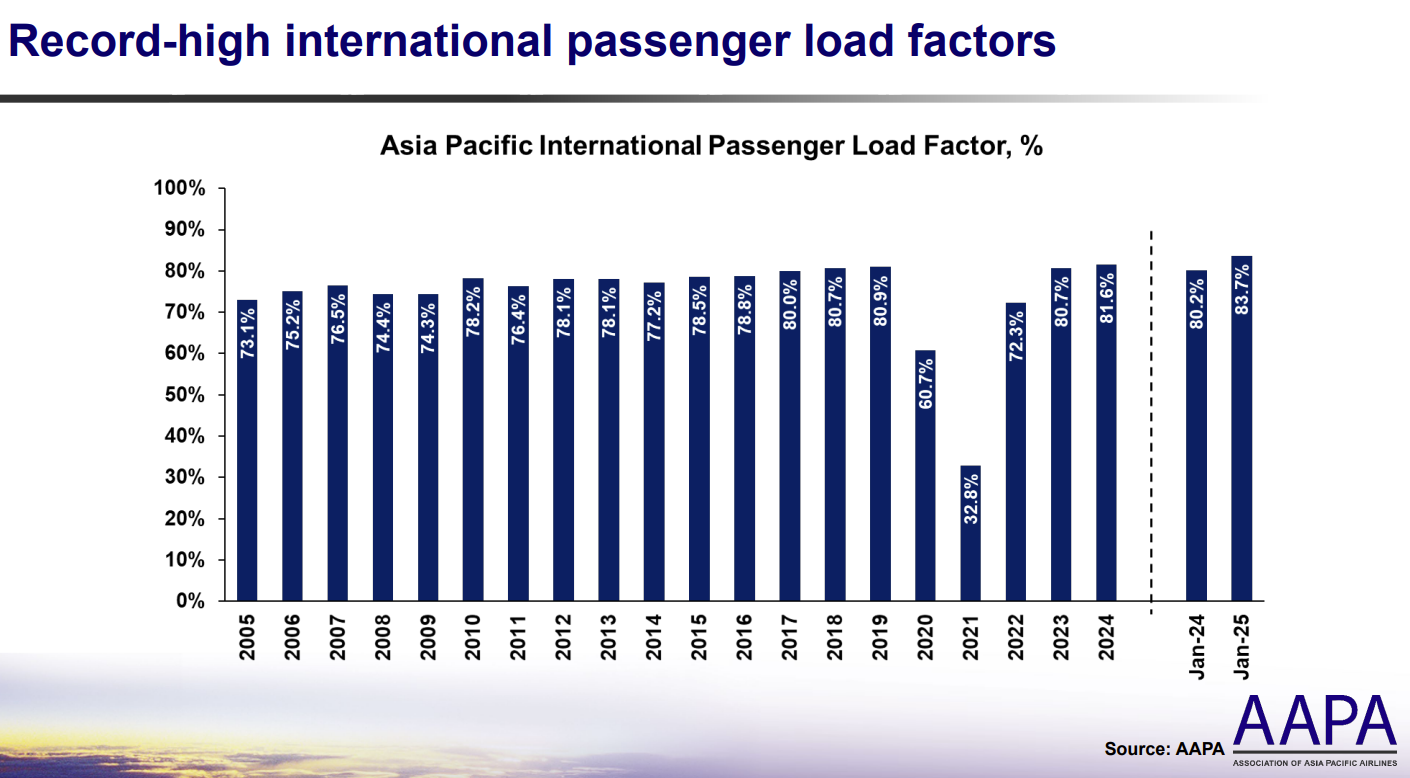

Asia-Pacific load factors are exceeding pre-pandemic levels, reaching 80.2% in January 2024 and 83.7% in January 2025. Before COVID-19, load factors in the region ranged from 80% to 81% between 2017 and 2019.

Despite the significant challenge of aircraft shortages, one of the biggest concerns for the industry is the cost of transitioning to an environmentally sustainable model. According to the IATA Sustainability and Economics Report, in a best-case scenario, 3,096 new renewable fuel plants will be needed at an estimated cost of $3.9 trillion. In the worst case, 6,658 new plants will be required at a cost of approximately $8.1 trillion.

Sustainable Aviation Fuel (SAF) is the biggest contributor to IATA’s goal of achieving net-zero emissions by 2050. However, the transition will cost airlines an estimated $4.7 trillion, a cost that will inevitably be absorbed, at least in part, through passenger fares.

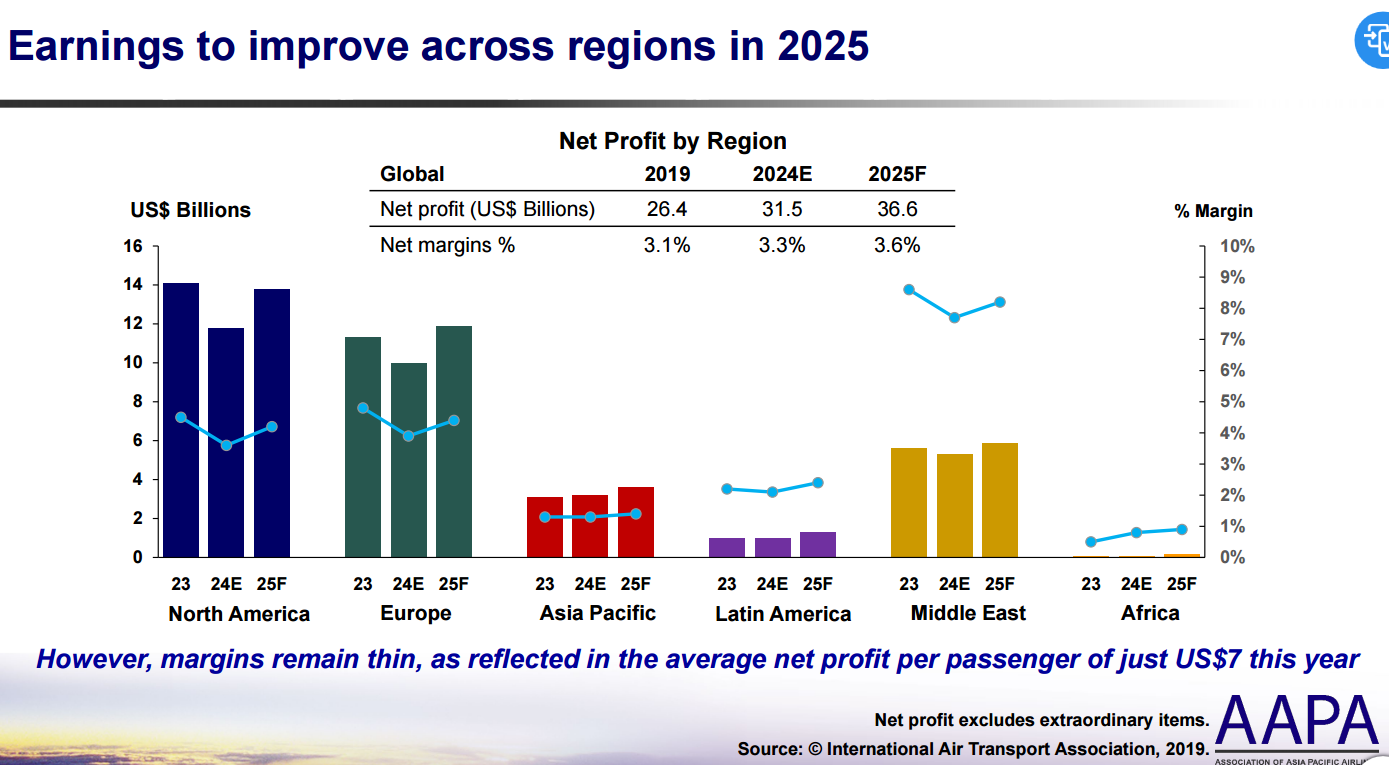

Regarding revenue and costs, margins remain thin, as reflected in the average net profit per passenger of just US$7 in 2024.

North America continues to lead in absolute net profit results. However, it is the only region yet to return to pre-pandemic profitability levels, primarily due to challenges in the low-cost segment.

Europe has faced multiple challenges in 2024, including rising wages, fleet groundings, noise-related flight restrictions, higher airport charges, and increased national taxes. As a result, profits are expected to decline slightly to $10 billion in 2024, representing a net margin of 3.9%. However, 2025 is expected to see healthy growth in Revenue Passenger Kilometers (RPKs) at 7%, supported by improvements in the low-cost carrier sector.

The airline industry in Asia Pacific continues to experience strong post-pandemic growth, but challenges such as supply chain constraints, rising costs, and the transition to sustainability pose significant hurdles. Growth in the region is expected to exceed the global average provided blockages in the supply chain can be smoothed out over the coming few years.

*AAAP = Association of Asia Pacific Airlines

Get the latest news and updates straight to your inbox

No spam, no hassle, no fuss, just airline news direct to you.

By joining our newsletter, you agree to our Privacy Policy

Find us on social media

Comments

No comments yet, be the first to write one.